Introduction

Wealth creation is a crucial goal for individuals and families seeking financial security and prosperity. While there are multiple investment avenues, real estate, particularly investing in open plots, has proven to be one of the most stable and rewarding options. Hyderabad, known as India’s IT hub, offers an excellent landscape for such investments due to its rapid urban development, booming economy, and attractive real estate opportunities. Investing in open plots in Hyderabad provides significant returns, flexibility, and security, making it an ideal choice for wealth creation.

In this comprehensive guide, we will explore why open plots in Hyderabad are a lucrative investment, the factors contributing to their appreciation, and how Hyderabad Consultancy Services can assist investors in making informed decisions.

1. The Growing Demand for Real Estate in Hyderabad

Hyderabad has emerged as one of the fastest-growing metropolitan cities in India. With its robust IT and pharmaceutical industries, world-class infrastructure, and favorable government policies, the city has become a top destination for real estate investment. The increasing population and rapid urbanization have led to a soaring demand for residential and commercial properties.

Several factors contribute to the rising demand for land in Hyderabad:

Booming IT and Industrial Sector: The presence of multinational corporations like Microsoft, Google, and Amazon has led to an influx of professionals, increasing the need for housing and commercial spaces.

Infrastructure Development: Hyderabad’s well-planned infrastructure, including the Outer Ring Road (ORR), metro expansion, and new expressways, enhances connectivity and accessibility.

Quality of Life: The city offers affordable living costs, low pollution levels, and a thriving job market, making it an attractive place for professionals and businesses.

Favorable Government Policies: The Telangana government actively promotes real estate growth through initiatives like the TS-iPASS and industrial corridors, encouraging investment in open plots.

2. Benefits of Investing in Open Plots in Hyderabad

Investing in open plots is a strategic move for long-term wealth creation. Below are the key benefits of choosing this investment option in Hyderabad:

a) High Appreciation Value

Unlike built-up properties, open plots tend to appreciate at a faster rate. With Hyderabad’s continuous expansion and upcoming commercial hubs, the demand for land is expected to increase, resulting in high returns on investment.

b) Low Maintenance Costs

Unlike apartments and villas, open plots do not require regular maintenance, making them a cost-effective investment.

c) Flexibility in Usage

Investors have complete control over how they want to utilize their land. They can develop it into a residential, commercial, or mixed-use property depending on future market trends.

d) Safe and Secure Investment

Unlike stocks and mutual funds, land investment is tangible and less volatile, ensuring safety and security.

e) Passive Wealth Growth

With increasing property prices, investors can see their wealth grow over time without active involvement.

3. Key Locations for Open Plot Investment in Hyderabad

Several areas in Hyderabad are witnessing exponential growth and offer great investment opportunities:

Shadnagar: Close to the ORR and the Pharma City project, making it a hotspot for real estate investment.

Yadagirigutta: A fast-developing area near the famous temple town with high tourism potential.

Shankarpally: Growing as a major residential and commercial hub due to its proximity to the IT corridor.

Maheshwaram: A rapidly developing industrial zone with major employment opportunities.

Kokapet & Kollur: Prime locations near IT hubs with ongoing commercial and residential developments.

4. Legal and Regulatory Considerations

Before investing in open plots, it is essential to verify the following aspects:

Land Title & Ownership: Ensure the seller has clear ownership and legal rights to sell the property.

HMDA or DTCP Approvals: Verify that the plot has proper approval from relevant authorities.

Encumbrance Certificate: Check for any legal disputes or pending loans on the property.

Layout Regularization Scheme (LRS): Ensure that the plot complies with government regulations.

Zoning Regulations: Understand land usage norms to avoid future legal issues.

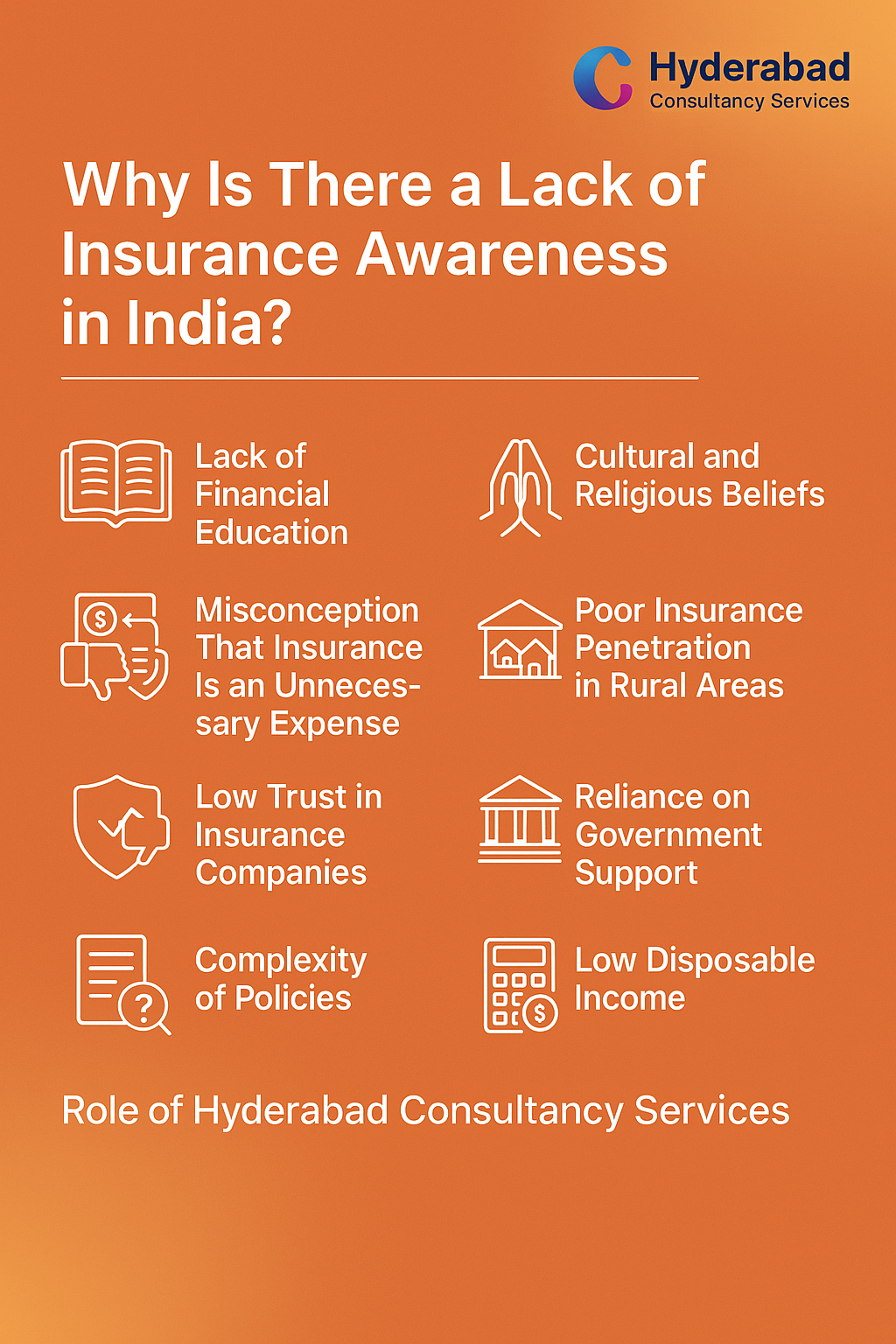

5. How Hyderabad Consultancy Services Can Help Investors

Navigating real estate investments can be challenging, especially for first-time buyers. Hyderabad Consultancy Services offers expert assistance to help investors make informed decisions. Their services include:

Site Visits & Property Analysis: Assisting investors in selecting the best plots based on location, infrastructure, and potential appreciation.

Legal Assistance: Ensuring all documents are verified and meet regulatory standards.

Market Insights & Price Evaluation: Providing insights into the best investment opportunities in Hyderabad.

End-to-End Support: Guiding investors through the buying process, from site selection to registration.

6. Future Growth Prospects of Hyderabad’s Real Estate Market

Hyderabad’s real estate market is poised for exponential growth due to:

Expansion of IT and Industrial Hubs: The upcoming IT parks and pharma industries will increase demand for land.

Government Initiatives: Development projects like the Hyderabad Pharma City and Genome Valley will attract global investors.

Increased FDI in Real Estate: International investments will boost infrastructure and property prices.

Growing Urban Population: With an increasing workforce, the demand for residential and commercial plots will rise.

7. Common Mistakes to Avoid When Investing in Open Plots

Investors must be cautious and avoid the following mistakes:

Not Verifying Legal Documents: Always cross-check property documents before finalizing the purchase.

Ignoring Location Advantages: Investing in isolated areas may result in lower appreciation.

Overlooking Development Trends: Stay updated on city planning initiatives to make informed investment choices.

Not Seeking Professional Guidance: Engaging experts like Hyderabad Consultancy Services can prevent costly errors.

Conclusion

Investing in open plots in Hyderabad is a strategic step toward long-term wealth creation. With rapid infrastructure development, a booming economy, and increasing land value, Hyderabad offers some of the best investment opportunities in India. However, conducting thorough research, verifying legalities, and seeking professional guidance from Hyderabad Consultancy Services can ensure a smooth and profitable investment journey.

By making informed decisions today, investors can secure a financially stable future and reap significant rewards from Hyderabad’s thriving real estate market.