Why Hyderabad Regional Ring Road (RRR)?

The Hyderabad Regional Ring Road (RRR) is being developed to support the city’s rapid expansion and address key infrastructure challenges. Here’s why the RRR is important:

1. Decongesting Hyderabad

- Hyderabad has seen massive growth, leading to increased traffic congestion.

- The existing Outer Ring Road (ORR) is becoming crowded, and the RRR will provide an alternative bypass for vehicles traveling long distances, reducing congestion inside the city.

2. Boosting Connectivity

- The RRR will connect multiple National Highways (NH 65, NH 44, NH 163, NH 765), ensuring seamless movement of goods and people.

- It will improve road access to towns and villages surrounding Hyderabad, reducing travel time significantly.

3. Promoting Economic Development

- Improved connectivity will boost industrial zones, IT parks, logistics hubs, and real estate growth.

- Areas around the RRR will develop into satellite townships, creating new employment opportunities.

4. Strengthening Hyderabad’s Future Growth

- As part of Telangana’s “Future City” Plan, the RRR will help in organized urban expansion, preventing haphazard growth.

- The Hyderabad Metropolitan Development Authority (HMDA) has expanded its jurisdiction to the RRR, ensuring better planning and infrastructure.

5. Enhancing Real Estate & Affordable Housing

- With the RRR’s development, land availability will increase, making real estate more affordable.

- Developers and investors are showing interest in areas near the RRR, which will lead to modern residential and commercial projects.

6. Facilitating Faster and Safer Travel

- The RRR will be a four-lane access-controlled expressway, ensuring smoother and safer travel.

- Vehicles moving across Telangana or towards other states won’t need to enter Hyderabad, reducing city traffic accidents.

7. National-Level Infrastructure Importance

- The project is part of Bharatmala Pariyojana Phase-2, a national highway development initiative by the Government of India.

- This makes the RRR a crucial infrastructure project that will enhance Telangana’s position as a key economic hub.

Conclusion

The Hyderabad Regional Ring Road is not just a road; it is a game-changer that will redefine the city’s transportation, economy, and urban development.

Benefits of Hyderabad Regional Ring Road (RRR)?

The Hyderabad Regional Ring Road (RRR) offers several benefits that will positively impact transportation, economy, real estate, and urban development. Here’s a breakdown of its key advantages:

1. Traffic Decongestion & Better Connectivity 🚗🛣️

- Reduces traffic load on the Outer Ring Road (ORR) and Hyderabad city roads.

- Provides alternative routes for heavy vehicles, keeping city roads free from congestion.

- Enhances connectivity between major highways like NH 65, NH 44, NH 163, and NH 765.

- Improves access to towns and districts surrounding Hyderabad, reducing travel time.

2. Boosts Economic & Industrial Growth 💼🏭

- Encourages industrial zones, logistics hubs, and business parks along the RRR corridor.

- Supports Telangana’s IT & manufacturing sectors by providing better transport links.

- Promotes employment opportunities as industries expand near the RRR.

- Reduces transportation costs for businesses, boosting trade and commerce.

3. Real Estate & Affordable Housing 🏡📈

- Increases land value in areas near the RRR, making them attractive for investment.

- Promotes affordable housing development by unlocking new land for urban expansion.

- Encourages satellite townships, reducing pressure on Hyderabad’s urban core.

- Better infrastructure and transport make distant areas more livable.

4. Agricultural & Rural Development 🌾🚜

- Improves market access for farmers, boosting their income.

- Encourages agribusinesses and food processing industries near the RRR.

- Enhances rural connectivity, improving access to healthcare and education.

5. Urban Planning & Infrastructure Development 🏗️🏙️

- Encourages planned urban expansion under Hyderabad Metropolitan Development Authority (HMDA).

- Prevents unstructured urban growth and promotes well-organized development.

- Enhances public infrastructure, including roads, bridges, and commercial spaces.

6. Time & Cost Savings ⏳💰

- Reduces travel time for commuters by providing faster routes.

- Lowers fuel costs due to improved road conditions and reduced congestion.

- Increases efficiency in transportation, benefiting both businesses and daily commuters.

7. National & Regional Importance 🇮🇳🌍

- Part of the Bharatmala Pariyojana Phase-2, making it a key national project.

- Positions Hyderabad as a leading economic hub in South India.

- Encourages investments from national and international businesses.

Conclusion 🚀

The Hyderabad Regional Ring Road (RRR) is a transformative project that will boost economic development, ease traffic congestion, and promote urban expansion. It will enhance connectivity, create new business opportunities, and improve the overall quality of life in and around Hyderabad. 🌟

Nearest places of Hyderabad Regional Ring Road (RRR)

The Hyderabad Regional Ring Road (RRR) will pass through several towns and villages around Hyderabad, connecting key districts in Telangana. Here are some of the nearest places along the RRR route:

Northern Section (164 km) 📍

- Sangareddy

- Narsapur

- Toopran

- Gajwel

- Pragnapur

- Yadagirigutta

- Bhuvanagiri

Southern Section (182 km) 📍

- Bhuvanagiri (common point for both sections)

- Choutuppal

- Ibrahimpatnam

- Kandukur

- Amangal

- Chevella

- Shankarpally

- Sangareddy (common point for both sections)

Highways Connecting to RRR 🛣️

- NH 44 (Hyderabad to Nagpur & Bengaluru)

- NH 65 (Hyderabad to Pune & Vijayawada)

- NH 163 (Hyderabad to Warangal & Bhopalpatnam)

- NH 765 (Hyderabad to Srisailam & Chennai)

Nearby Notable Places 🏞️🏙️

- Medak Fort (Near Sangareddy)

- Yadadri Temple (Near Yadagirigutta)

- Ramoji Film City (Near Ibrahimpatnam)

- Ananthagiri Hills (Near Chevella)

- Sri Lakshmi Narasimha Swamy Temple (Near Choutuppal)

The RRR will connect urban and rural areas, creating new economic and residential hubs while improving connectivity across Telangana. 🚀

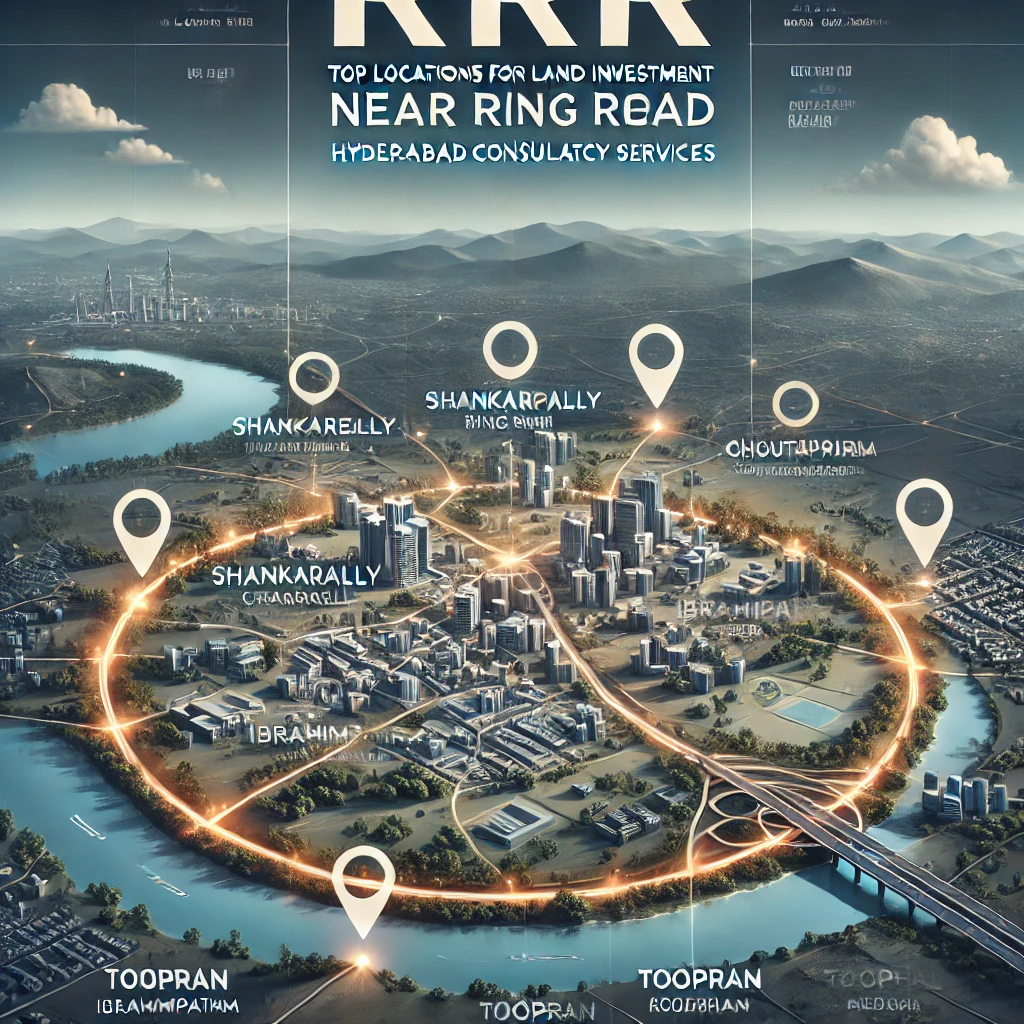

What is the best places for land purchasing based by Hyderabad Regional Ring Road (RRR)?

If you’re looking to purchase land near the Hyderabad Regional Ring Road (RRR) for investment, residential, or commercial purposes, here are some of the best locations based on potential growth, connectivity, and infrastructure development:

🔥 Top Locations for Land Investment Near RRR

1. Shankarpally 📍

✔️ Fast-growing residential & commercial hub

✔️ Proximity to IT corridors & financial district

✔️ Near Neopolis, Kokapet, and Tellapur

✔️ Well-connected via ORR & RRR

💰 Best for: Residential layouts, farmhouses, and real estate investments

2. Chevella 📍

✔️ Close to Neopolis, Gandipet, and Narsingi

✔️ Rapidly developing with villa projects & gated communities

✔️ Proximity to Ananthagiri Hills (tourist attraction)

✔️ Land prices are still affordable compared to western Hyderabad

💰 Best for: Farmhouses, resorts, and long-term appreciation

3. Sangareddy 📍

✔️ Major industrial & educational hub (IIT Hyderabad is nearby)

✔️ Excellent connectivity via NH-65, ORR & RRR

✔️ Close to Pharma City, ITIR, and Patancheru Industrial Zone

💰 Best for: Commercial plots, warehouses, and residential development

4. Bhuvanagiri 📍

✔️ Close to Yadadri Temple (spiritual tourism hotspot)

✔️ Located on Warangal Highway (NH-163)

✔️ Infrastructure development boosting demand

✔️ Planned Yadadri Growth Corridor

💰 Best for: Residential plots, resorts, and commercial ventures

5. Toopran 📍

✔️ Upcoming industrial & logistics hub

✔️ Located on Nagpur Highway (NH-44)

✔️ Ideal for warehouses, agro-based businesses

✔️ Affordable land rates with high appreciation potential

💰 Best for: Agricultural land, warehouses, and logistics

6. Choutuppal 📍

✔️ Located on Hyderabad-Vijayawada Highway (NH-65)

✔️ Near Pharma City, a booming industrial corridor

✔️ Good demand for residential & commercial projects

✔️ Affordable land rates compared to Hyderabad’s outskirts

💰 Best for: Residential layouts, commercial buildings, and logistics

7. Ibrahimpatnam 📍

✔️ Well-connected to Vijayawada Highway & ORR

✔️ Close to Ramoji Film City (tourist attraction)

✔️ Rising demand for residential & plotted developments

💰 Best for: Residential plots and commercial spaces

💡 Key Factors to Consider Before Buying Land Near RRR

✅ Purpose: Residential, commercial, or long-term investment?

✅ Government Approvals: Check for HMDA, DTCP, or RERA approvals.

✅ Infrastructure Growth: Look for upcoming roads, metro expansion, and industries.

✅ Legal Verification: Ensure the land has clear title & no disputes.

✅ Nearby Developments: IT parks, industrial zones, or commercial hubs boost land value.

🔮 Future Growth Potential

- Western RRR (Shankarpally, Chevella, Sangareddy): High demand due to IT sector & premium residential projects.

- Northern RRR (Toopran, Gajwel, Medak): Emerging industrial & logistics hub.

- Eastern RRR (Bhuvanagiri, Yadadri, Choutuppal): Religious tourism & residential expansion.

- Southern RRR (Ibrahimpatnam, Kandukur, Amangal): Affordable pricing with long-term growth potential.

📈 Investing near RRR now could yield high returns in the next 5-10 years! 🚀

Are You Searching for Land/Plot in Hyderabad?

🏡 Are You Searching for Land/Plot in Hyderabad? 📍

Hyderabad is one of the fastest-growing cities in India, and buying a plot or land here is a golden investment opportunity! Whether you’re looking for residential, commercial, or investment purposes, we have the perfect locations for you.

🌟 Why Invest in Land in Hyderabad?

✅ High Appreciation – Rapid infrastructure growth ensures rising land value.

✅ Great Connectivity – Proximity to highways, ORR, RRR, and upcoming metro expansions.

✅ IT & Industrial Hub – Close to top IT parks, business zones & upcoming developments.

✅ Peaceful Living – Choose from gated communities, farm plots, and villa projects.

📍 Top Locations for Land Investment

✔️ Shankarpally & Chevella – Perfect for premium residential projects & farmhouses.

✔️ Sangareddy & Patancheru – Industrial & commercial hotspot with high returns.

✔️ Bhuvanagiri & Yadadri – Fast-growing spiritual & residential hub.

✔️ Choutuppal & Ibrahimpatnam – Ideal for affordable housing & commercial projects.

✔️ Toopran & Medchal – Best for logistics, warehouses & business investments.

🏆 What We Offer?

✅ HMDA, DTCP & RERA-approved plots

✅ Clear legal documentation & hassle-free registration

✅ Flexible payment options & bank loan assistance

✅ Plots in prime locations with future growth potential

📞 Contact Us Today!

Don’t miss out on the best land investment opportunities in Hyderabad.

📍 Visit our site locations or call us at 9949161043 for more details.

🚀 Secure your dream plot today & watch your investment grow! 💰